“She Nailed It”, Lauren Sánchez’s Marvelous Glass Dress Steals the Spotlight at 2024 Met Gala, Sparking Heated Buzz

Let’s not kid ourselves; everyone dreams of becoming rich. However, working 60 hours a week isn’t enough to achieve this. You need to change your mindset, as rich and poor people view things from completely different perspectives. Here are the most common mistakes that prevent you from becoming wealthy.

Cleaning and cooking are activities that are hard to avoid, but it’s wrong to spend too much time on them. There are only 24 hours in a day, and after sleep and going to work, you have only 5-6 free hours at best. If you spend them on dusting, making soup, and roasting chicken, there’ll be no time left to improve your life. And when our time is worth more than the services of professionals, it’s more profitable to delegate household chores to them.

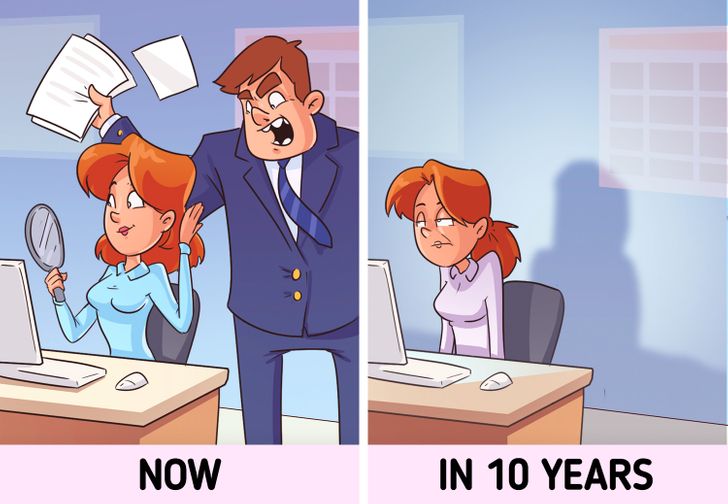

We often tend to ignore difficulties and unpleasant tasks, hoping that they’ll solve themselves. However, these things might hinder your financial success. Negative feedback from your boss, unpaid bills, conflicts, and more are stopping you from becoming rich.

Being a “Pollyanna” is an adjective given to people who tend to agree with positive comments about themselves exclusively, ignoring all negative information. It originated from the book, Pollyanna, a novel about a girl that could find positive things in everything.

To avoid this mistake, try to take into account all information and evaluate it critically. Accepting problems and taking criticism isn’t easy, but ignoring these things can prohibit the opportunity to improve.

The amount of sharing economy users is expected to double by 2021. For those who don’t know, the sharing economy is a way that consumers can share and use services either for free, for a fee, or through bartering and exchanging goods. Some good examples of this are companies like Airbnb, Uber, and eBay.

These platforms give us an opportunity to make extra income from the assets we have. You can rent out your garage, your land, or even the tools you have. Take a look at your possessions and see what things could be useful for others. Creating an ad doesn’t take much time, and it will give you an opportunity to make some additional weekly income.

Researchers conducted an experiment where people were told to imagine that they were doctors that were choosing a type of therapy for a patient. They had a choice: to try the treatment, which led to death in 15% of cases; or not to try any treatment, which was lethal 20% of the time.

13% of people chose to not try any treatment because they’d feel less responsible if the patient died. This cognitive trap makes us believe that not doing anything is safer than trying and taking a risk.

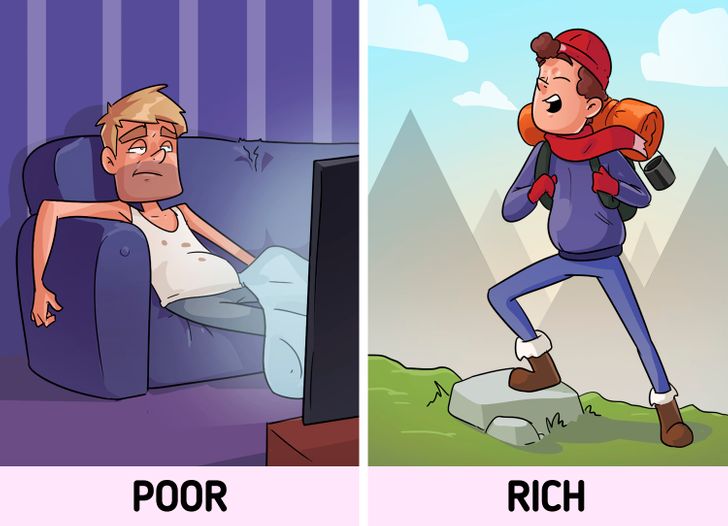

It seems like being passive and watching TV doesn’t cost a lot, but think about all the time you waste. You can work extra hours to earn money, learn new skills, or think about your own business — it simply requires you to take a risk to make some additional income for the future.

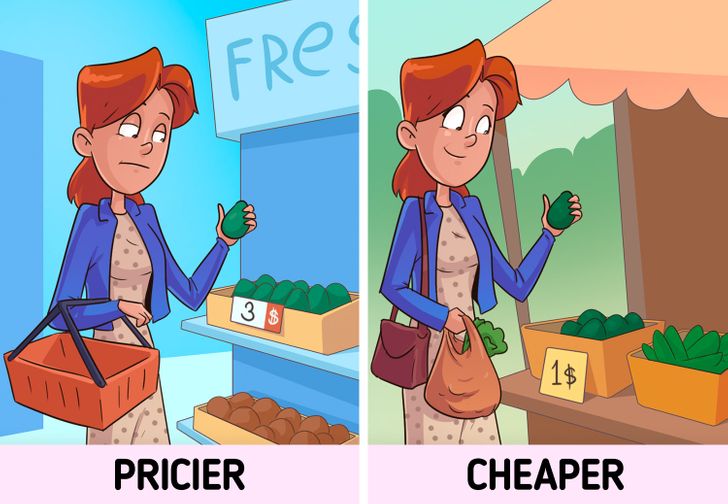

Unless you’re familiar with prices, you’ll end up spending more. Marketers are experts at tricking us, making the temptation to buy products with discounts high — but remember, the same product might be much cheaper in a different store.

Some expenses have to be planned many years in advance. If you want to buy a car, it’s better to save money in advance instead of acquiring credit. If you don’t have long-term goals, you’re at risk of spending all your savings or taking on a loan.

If you decide that films can be seen at home, eating out isn’t for you, or that concert tickets are way too expensive, after some time, you’ll feel burnout and become dissatisfied with your life. While cutting your expenses, you can reduce entertainment spending, but don’t get rid of this entirely. For example, meet up with your friends, but instead having a chat in a restaurant, invite them to your place for a cup of tea.

People who are rich tend to have several close friends, while the poorest people are among the loneliest. While focusing on finance, we tend to forget about our friends. But the problem with this is that friends have a positive influence on all aspects of our lives, including finance. Having someone who believes in you and is always there for you shouldn’t be overlooked.

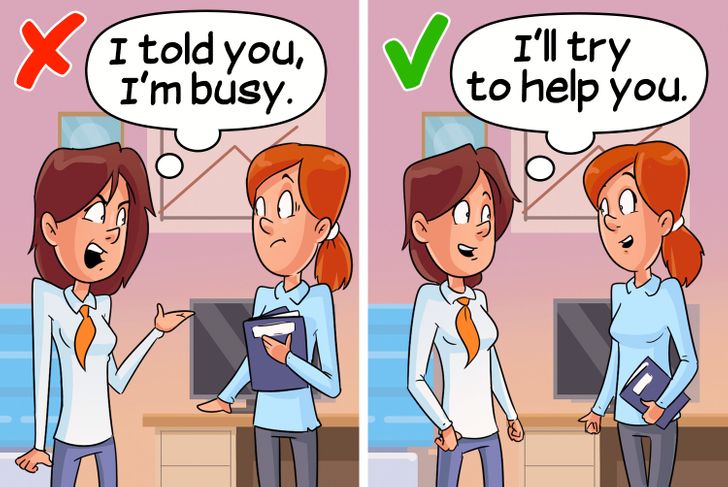

You can’t succeed alone, so negotiating skills are an indispensable trait in wealthy people. The best negotiators always have the best salary, working environment, and support from their boss. If negotiations are like taking bullets for you, try different online courses for guidance, and if you want to become affluent, don’t miss the importunity to practice in real life.

People from ordinary families often refrain from discussing their health issues, fearing they might be seen as burdensome or needy. They typically prioritize the well-being of others over their own, silently enduring ailments to avoid causing any inconvenience. When it comes to seeking medical attention, they may delay or avoid it, worried about the financial strain it could place on their family.

This tendency to downplay their health concerns stems from a deep-rooted sense of humility and self-reliance. Despite their own suffering, they find solace in knowing they haven’t troubled anyone, maintaining a quiet resilience that underscores their everyday lives. Wealthy people know that health is paramount and are not afraid to make someone uncomfortable.

Read on to discover other habits of wealthy people that you should adopt.