10+ Things That Were Unacceptable in the Past, but Are Pretty Normal Now

Countless individuals aspire to achieve wealth and dedicate long hours striving to make it happen. Yet, hard work alone often falls short. Transforming your perspective and breaking free from limiting beliefs is equally essential for financial success. Here are some clear indicators that might reveal if someone is steering away from the road to prosperity.

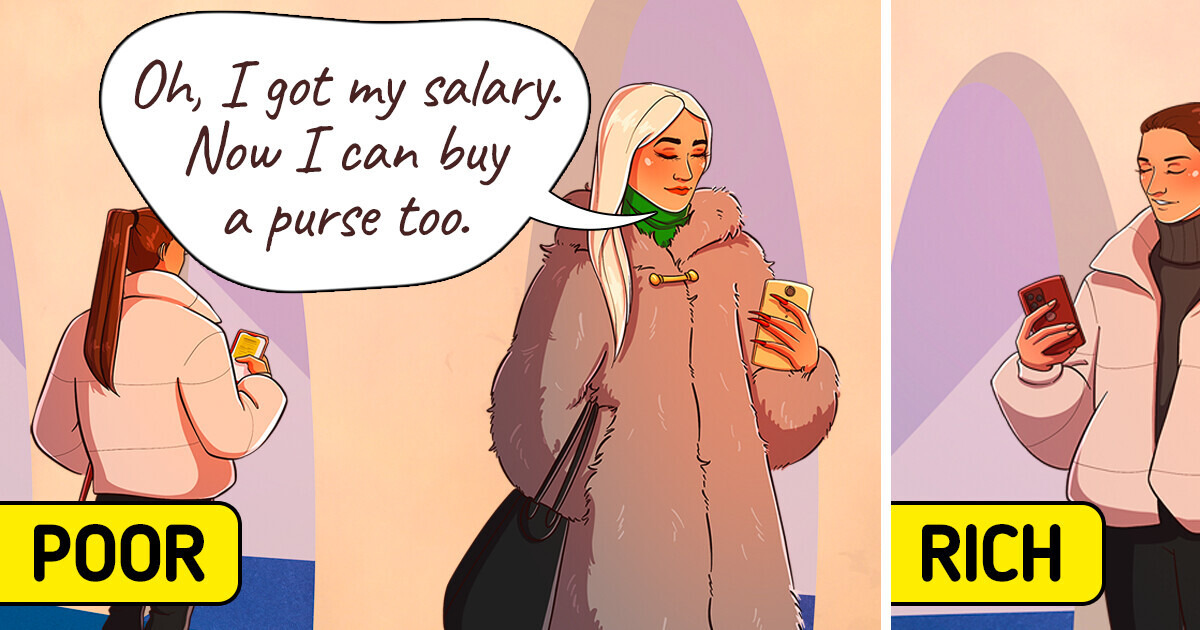

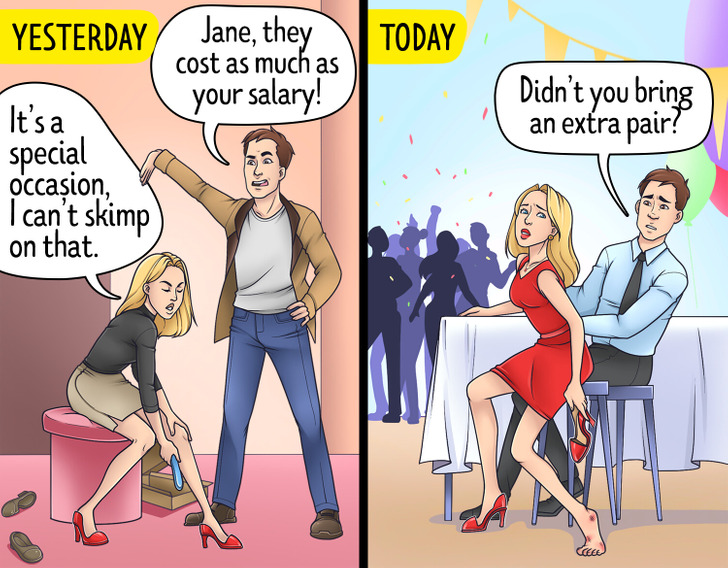

Financially stable individuals typically avoid making impulse and unnecessary purchases because they prioritize long-term goals and financial security. They are more likely to plan their spending, set budgets, and save for future needs, which helps them avoid the temptation of instant gratification. Instead of succumbing to fleeting desires, they focus on making thoughtful and intentional purchases that align with their financial goals. By practicing discipline and self-control, they ensure that their spending habits support their overall well-being and financial independence. This mindset allows them to build wealth and maintain a stable financial future.

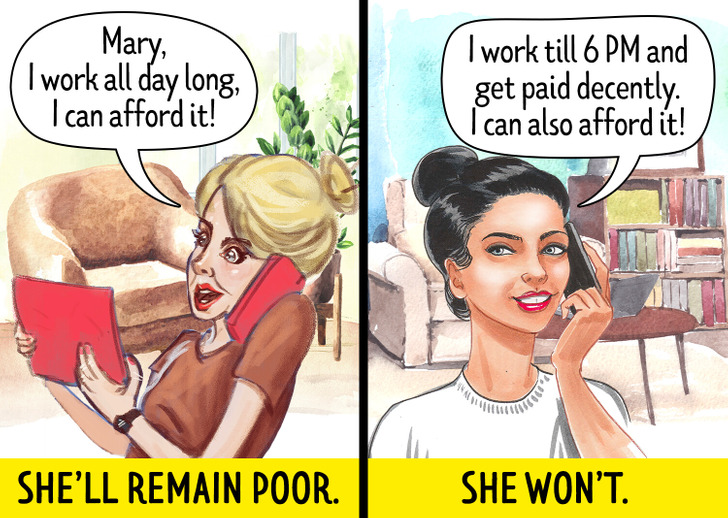

They say you don’t have to work 12-hour days to earn good money — all it takes is focus and skill development. When you work endlessly, it can feel like you’re stuck on a hamster wheel, with no time to think about improving your life or pursuing personal interests. By the time you get home, you’re often drained, with no energy left for anything else.

However, when someone learns to balance work with hobbies and organizes their routine differently, they can perform their tasks without compromising their quality of life. This approach frees up time for personal growth, hobbies, and learning, all of which can ultimately help advance their career.

Having enough money saved to support yourself for a couple of months in an emergency is a clear sign that you’ve developed a healthy relationship with money. On the other hand, someone who relies on debt during unexpected situations is not yet prepared to build wealth. To create a solid savings foundation, you can follow Warren Buffett’s advice: “Don’t save what is left after spending, but spend what is left after saving.” This mindset encourages prioritizing savings first, ensuring financial security before managing other expenses.

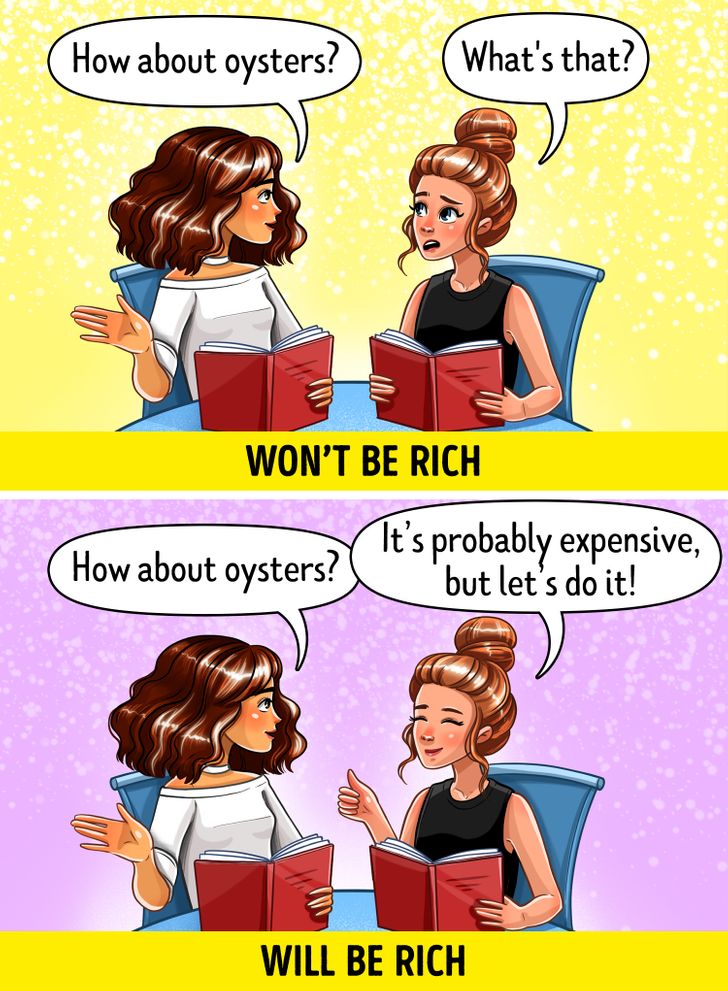

“How many millionaires do you know who have become wealthy by investing in savings accounts?” businessman Robert Allen once asked. If you keep doing what you’ve always done, you’ll keep getting the same results. This doesn’t mean you should invest half your salary in lottery tickets or risky stocks. However, avoiding all risks and hoping to spend your life in the comfort zone is one of the surest ways to stay far from wealth.

Business coach Jaime Tardy once said, “The primary difference with wealthy people is that they’re in control of their money, and they don’t let money control them.” If you don’t track how much money is left in your wallet after shopping, wealth may not come your way. To achieve financial success, it’s crucial to know your income and expenses at all times. This awareness will allow you to plan your budget, prepare for unexpected costs, and, ironically, give you peace of mind.

Wealthy individuals understand their limits, both financially and personally. They know when to say “no” to opportunities that don’t align with their goals or values. By setting clear boundaries, they avoid overextending themselves and maintain control over their resources. This self-awareness helps them focus on what truly matters and make smarter, more strategic decisions that contribute to long-term success.

Using a credit card to pay for a vacation is a clear indication that something is off with your financial situation. While everyone needs a break, going into debt for leisure is a poor decision, as you’ll end up paying off that trip instead of saving for the next one. Thomas Jefferson, one of the Founding Fathers of the United States, once advised, “Never spend your money before you have it.” Although credit cards didn’t exist in his time, there were plenty of ways to fall into debt, making his advice as relevant today as it was back then.

The world is evolving at a rapid pace, and staying stagnant means falling behind. If you don’t invest time and money into acquiring new skills and improving your expertise, you’ll likely stay at the same income level, and wealth will remain out of reach. Elon Musk once said that when asked how he learned to build rockets, “I read books.” Continuous learning is essential for growth, both professionally and financially.

Cleaning and cooking are necessary tasks, but spending too much time on them can be counterproductive. With only 24 hours in a day, and much of that taken up by work and sleep, you’re left with just a few hours of free time. If you spend those hours doing household chores like dusting or preparing meals, you’ll have little left for activities that can improve your life. When your time is more valuable than the cost of hiring professionals, it’s often smarter to delegate those chores to them.

People who are focused on building wealth understand the power of discretion. While it’s tempting to share your goals with others, too many opinions and outside influence can derail your progress. Successful individuals tend to keep their plans close to the chest, working quietly and letting their actions speak for themselves. By doing so, they avoid unnecessary distractions and keep their energy focused on achieving their dreams.

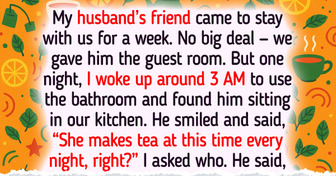

Many wealthy people are cautious about their spending and prioritize value over impulse. Those who struggle financially often make the mistake of splurging on things they don’t need, chasing short-term satisfaction rather than long-term stability. Being mindful of where you allocate your money is key—wise individuals focus on investments that bring lasting value, rather than indulging in excessive or frivolous purchases that don’t contribute to their financial growth.

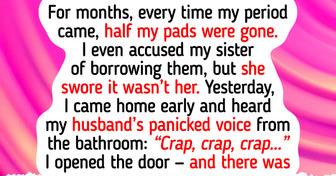

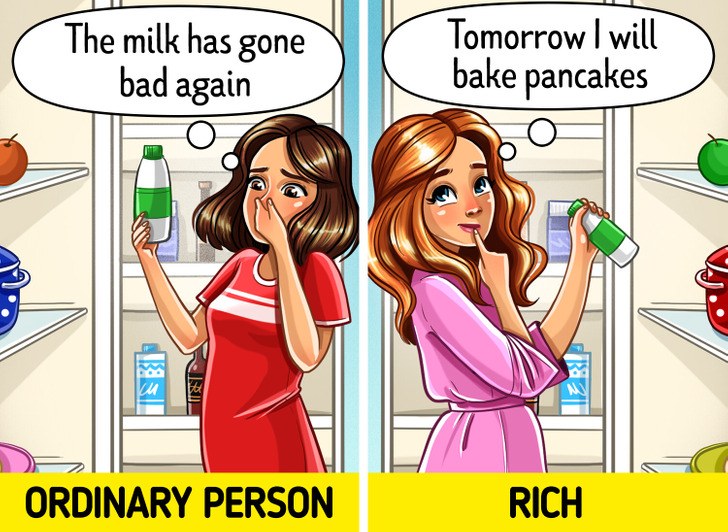

Wealthy people understand the value of every dollar they spend, including on groceries. They plan their meals carefully to avoid wasting food, ensuring every purchase is intentional. Throwing away food not only wastes money but also reflects poor financial habits that can hinder long-term wealth building. By managing resources wisely, they maximize their budget and contribute to a sustainable lifestyle.

Here are more traits of mindset and worldview that distinguish a financially secure person from someone used to living paycheck to paycheck.