NECER loan anything to a friend or relative unless you can afford to never get it back. If you expect it and don't get it the money/item as well as the relationship will be gone. I learned the hard way. If I am not comfortable gifting something my answer to the request is NO.

My DIL Requested Money, and My Response Surprised Her

One of our readers shared a story that feels all too familiar for many families. When her daughter-in-law once again asked for a hefty loan, she didn’t flat-out refuse. Instead, she agreed—but only if her daughter-in-law accepted a surprising condition that no one saw coming.

Here is her letter.

My daughter-in-law suddenly messaged me, asking for a large loan to “cover some bills.” No details, no explanation — just the number. And it wasn’t the first time she had done this.

I decided enough was enough. So I invited her over and said with a smile, “Of course I’ll help — but only if you show me your budget and sign a repayment plan.”

She burst out laughing, as if it had to be a joke.

It wasn’t.

The moment she realized I was serious, her mood flipped. She accused me of not trusting her. I told her calmly, “I do trust you with your choices — just not with my money unless there’s responsibility attached.”

She stormed out. Later, my son texted me angrily, saying I had “humiliated” her.

Maybe I did.

But my money stayed exactly where it belongs — in my account — and so did my boundaries.

What you should know before gifting money to family.

Money experts caution: pause before you pull out the checkbook.

Special occasions—holidays, birthdays, weddings, even tough patches in life—often spark a desire to be generous. Many parents and grandparents, especially those who are retired or widowed, want to ease the burden for loved ones by offering financial help. The gesture comes from the heart, but without a plan, it can trigger stress, conflict, and even damage your own financial safety net.

Yes, money can solve problems. But it can also create new ones. That’s why professionals recommend keeping these rules in mind:

- Protect Yourself First

Before giving thousands to one child or grandchild, think about the ripple effect. Will others expect the same? And most importantly—can you afford it without jeopardizing your own future? A quick check-in with a financial advisor can prevent long-term regrets. - Draw the Line Clearly

If a loved one asks for help with bills, rent, or a business idea, decide from the start: is this a loan with conditions, or a gift with no strings? Boundaries matter. If you skip this step, your kindness can quietly turn into an obligation. - Don’t Build Dependence

One of the most common traps is giving again and again, year after year. That steady stream of “help” can set expectations and even hold your family back from learning independence. If your support is meant to be one-time only, say it clearly. Otherwise, your generosity could become a lifeline they never learn to live without.

Here you can read the story of a woman who got into a conflict with her in-laws over money.

Comments

Related Reads

My DIL Wanted Me in the Delivery Room, but I Refused — I’m a Grandma, Not a Nurse

10 Celebrities Who Look Nothing Like They Used To

16 Heartfelt Stories Proving Kindness Heals More Than We Realize

10kg Breasts Forced a 22-Year-Old Student Into Life-Changing Surgery

She Was Called the Most Beautiful Girl in the World — Today Her Look Sparks Heated Controversy

10+ Celebrity Kids You Rarely See in Public

“She Clearly Got a Hip Job!” Megan Fox, 39, Makes First Public Appearance After Baby No. 4

12 Nannies Who Faced Challenges Far Bigger Than Babysitting

How to Look and Feel Amazing in Jeans

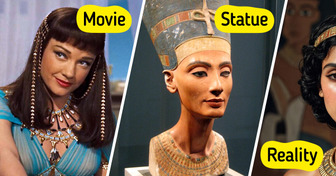

14 Historical Figures We Know Only Through Art — and What They Actually Looked Like

13 People Who Chose Plastic Surgery and Are Totally Obsessed with Their New Looks

17 Stars Who Proved You Can Change Your Look Without Losing Your Spark