I Spied on My Daughter and Uncovered a Shocking Truth That Shattered Our Family

History knows a lot of examples of people that’ve managed to go from rags to riches. Unfortunately, there are opposite stories too. Even the richest people can lose their wealth. And some of them even share their stories online.

We at Now I’ve Seen Everything found out what it’s like to lose everything you have in a short period of time.

My friend married a woman who had been a multi-millionaire since birth. Saying that they were rich is an understatement. They only flew first or business class, he got a new Porsche or Mercedes every single year, and they always lived in the best areas in Manhattan. They had a lot of money, but they didn’t work. After all, they never needed to. She received a monthly allowance from her family that I believe was around 700K to 1M per year.

They lived this life for around 10 years. Then, they had a disagreement with their family, and they stopped receiving the allowance. But they are in their 50s, they have never worked and have no professional skills, and they have to pay rent (as they don’t have a home), pay all their bills, and above all, health insurance with that amount. My friend’s wife told me that the biggest issue is that they don’t know how to live like that. She can’t imagine what it’s like to do their own grocery shopping, and worse than that, go to Walmart with a shopping list. And 6 months ago, when I saw them for the last time, I invited them to have a coffee at Starbucks, and that was the first time in more than 15 years that they said thank you after I offered to pay for our breakfast. I would not dare to say that this experience was humbling to them because they were always nice people, the difference is that they were nice people with lots of money. © Jerry Strazzeri / Quora

We just purchased a beautiful new home in a great area of the city. Zero debt plus 6 figures in the bank. Then everything came crashing down... fast and HARD! Marriage dissolved almost overnight. And with it, I also lost my immediate family — brother and mother. And at the same time, my work let me go. My ex-husband wanted to keep all the property and wouldn’t give me a divorce.

Plus, I had to now pay my very expensive divorce attorney. Several months later, my work asked me to return, and I did. 45 lbs bigger and clearly depressed. Everyone at work was flabbergasted. Few could barely recognize me. Some naively asked if I was happy to be back. I responded, “This feels like attending your ex-boyfriend’s wedding, and he’s marrying a supermodel.” © unknown author / Quora

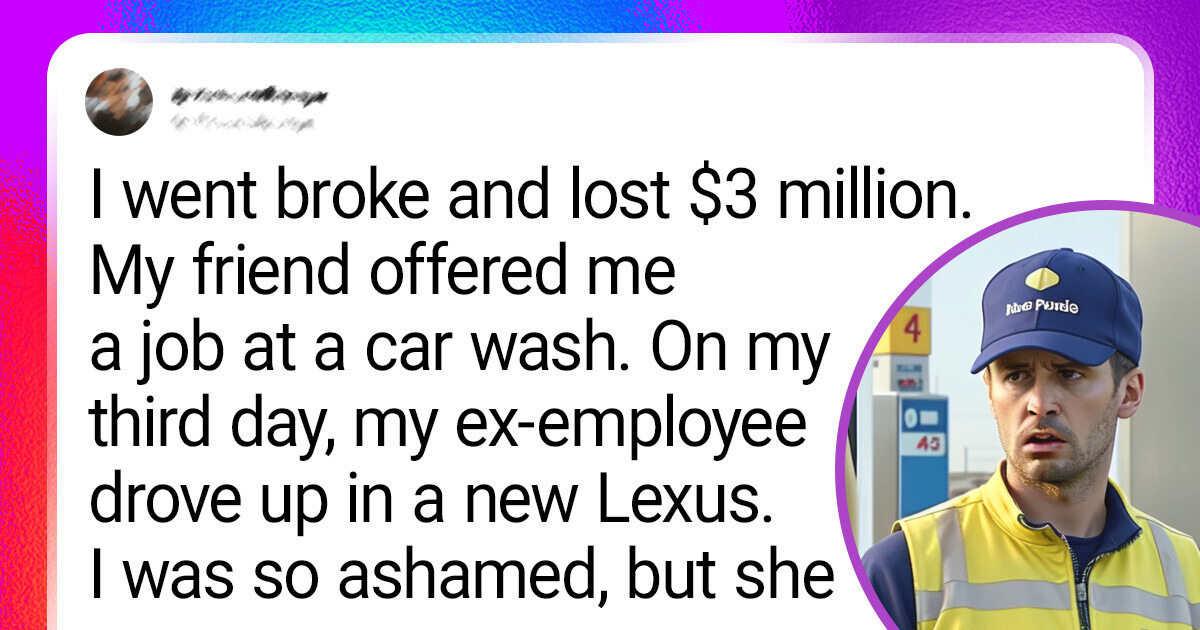

Due to the crisis, I lost $3 million. I kept looking for work in my field but found nothing. I lost my confidence. A friend of mine owned a couple of car washes. He offered me a job. I declined because I remembered my dad say it was a humiliating job. But then I agreed when I didn’t have money for a niece’s birthday present.

On my 3rd day of dragging myself into work, a girl that I’d hired as my assistant 5 years previous pulled in — driving a brand-new Lexus. She smiled, jumped out of her car, ran over, and gave me a hug. She said I was a great boss. I was about to die of shame. None of the many people I met thought I was a loser. All of them respected me, and the local article even printed a story about my life. © Michael Aumock / Quora

A family member went from having millions of dollars and living in Beverly Hills to being a taxi driver. The reason is losing several million dollars through poor investment choices, profligate spending, and multiple divorces. He can’t quite let go of his glorious past. In fact, he tells his taxi passengers about the mansion he used to live in. For a while, he was holding out hope that he could “turn things around” by betting on the right stock. Now he’s worried about how he will make ends meet once he can’t drive a taxi anymore. He has purposely lost touch with all his friends because of the embarrassment.

Going from being wealthy to being poor isn’t necessarily a death sentence — plenty of people have bounced back from bankruptcy. In fact, many have bounced back from their setbacks even stronger than before. Unfortunately, this relative of mine chose to blame everyone else for his problems instead of coming to terms with his predicament. Sadly, at age 68, time ran out. The lesson for me is to stay conservative in my investments, live below my means, and most importantly, DON’T GET DIVORCED! © Jonathan Chen / Quora

I became a mortgage broker in 2003 and would consider myself financially well off before the crash in 2008. Most of my savings disappeared after I had back surgery. By the time I recovered, the mortgage business died. No savings, no incoming work, unable to get processed loans closed, no money coming in. My father died unexpectedly, and I’m consumed with sadness. I sell all my belongings to move out of my “pending foreclosure” home, and to have something to live on as no one is hiring at the time.

7 years later, my bills are minimal, and I live within a budget. I pay cash for everything, including my car and furnishings. I’ve gone on to get my Bachelor’s and Master’s degrees in my lifelong interest of Psychology. I do preventative healthcare and have coverage for any medical expenses. I don’t buy new, always second-hand. I buy disaster furnishings and make them into something I adore, far more than anything that’s new. I’ve learned more about life and myself since losing everything than I did the 25 years before that. I feel grateful that the circumstances occurred the way they did for me to get to this place in time. © Kathy Nelson / Quora

It feels like you are the biggest idiot/loser in the world. It is embarrassing, you don’t want to go out because you “know” everyone is laughing at you behind your back. You want to just hide out and become a recluse. For me, in both cases, the losses were sudden and huge. However, I must admit that these events made all the difference in my third climb up the ladder and here is why. You realize who your true friends are. You quit throwing money away by chasing multiple things at one time and you focus on what you can do best.

I also do not live a wealthy lifestyle now, even though I make a LOT more money than I ever have. Would people laugh at me behind my back? Of course, they would. Does it matter? No, because I know that because of my previous lessons, the next time I might have to climb out of the hole it would be even easier because of the people (friends and family) with whom I have surrounded myself. © Louie Keen / Quora

When I had money, I had a good life. When I lost it all, life started to suck. I had a decent apartment, a good wife, and enough money to take 4 vacations a year. But it all went in 2000 when I trusted the wrong person to be General Manager of my company. He got greedy, started stealing money from the company, and kept on stealing until it sent the company under. I sunk my life savings into a new business venture that didn’t take off.

I have had to survive by starting a small business of my own with no capital behind me. My wife stood by me for the first couple of years of having no money, but she got impatient after a while and divorced me. It feels like being involved in an accident where you end up being partially paralyzed. I remember a line from Fight Club — “You don’t own your possessions — your possessions own you.” © Nick Pendrell / Quora

The financial collapse destroyed both my businesses — the 15+ year-old reliable marketing firm and the 5-year old blooming web business. We went bankrupt before Christmas. We didn’t have a place to move our stuff and had nothing to pay to the movers with. We had a sell a lot of things to have money for food.

Then there is the fear. What happens if something happens to the mini-van? We drive it as little as possible. Of course, there is the shame too. It’s lessened because we know that the financial crisis was beyond our control. And then there is the anger. Did I mention I built 2 businesses? That I worked every waking hour for years and years? And that I’m now in my 50s, so the odds of saving enough for any kind of retirement get steeper by the month? I’m probably at the worst part of this right now. © unknown author / Quora

Spent my childhood in a well-off, a bit above the average income family. As I got older, less money started coming in and by the time the economic crisis hit, my whole family went from hero to zero (family business went bankrupt). And since everyone in my family never gave a second thought that they might not make as much money as they were right now, nobody saved money. Went from never worrying about a dime to eating the same huge pot of beans 5 days straight over 6 months, skipped all high school holidays, events, and most 18th birthday celebrations (as I couldn’t bring gifts).

Let’s just say it was an eye-opening experience that I would never rewind and change. I’m 23 now, have a stable freelance job, and own my own agency as well. Currently, in the final months of paying off the massive debts, my family accrued during this period, and I’m supporting my sister, father, and mother. © Gejminator / Reddit

The author of this article tries to put aside some money every month. What is your relationship like with money?