11 Comics That Show What Sacrifices Women Make Daily for the Sake of Beauty

Many people dream of getting rich and work late into the night to turn that dream into reality. However, it’s not enough. You also need to change your mindset and let go of beliefs that hinder the path to financial success. We found several obvious signs that can help determine that a person isn’t on the right path to make a fortune.

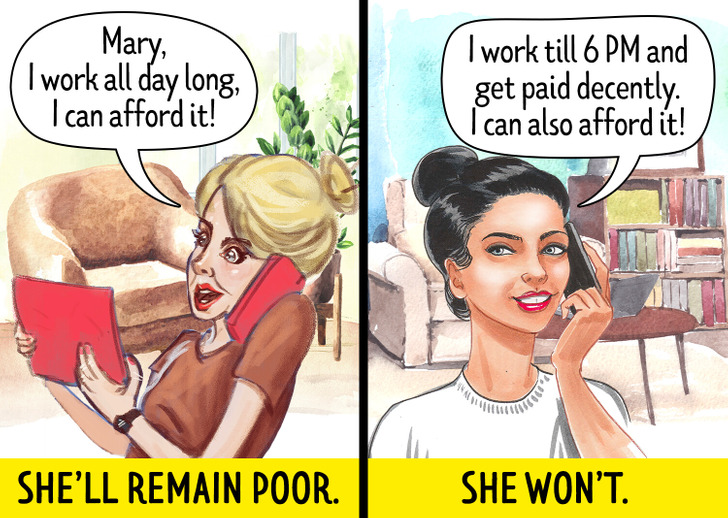

They say that there is no need to work 12 hours a day to earn good money — all you need to do is put your mind to it and master your skills instead. All because when working all day long, you might end up feeling like you are living your life in a hamster wheel. And there is no time to think about how to upgrade your life, not to mention other necessities and hobbies. There is simply no energy left when you come home feeling like a squeezed lemon.

When a person learns to switch between work and hobbies and builds up their system a bit differently, they will be able to perform their duties without damaging their quality of life. They will get free time that can be spent on both hobbies and education that will give them an opportunity to move up the career ladder.

Having some money left that will help you live for a couple of months in an emergency situation is one of the signs of a person who has built up a good relationship with money. But a person who is forced to go into debt during any unexpected situation isn’t ready to get rich. You can follow the advice of Warren Buffett to build your savings, “Don’t save what is left after spending, but spend what is left after saving.”

“How many millionaires do you know who have become wealthy by investing in savings accounts?” businessman Robert Allen once asked. If you continue doing what you’re already doing, you’ll get the same results. This doesn’t mean that you have to spend half of your salary on lottery tickets, and that the rest should be invested in dubious stocks. But avoiding any risks and hoping to spend your whole life in a comfort zone is one of the best ways to not get rich.

Writer and salesman, Zig Ziglar, once said, “Rich people have small TVs and big libraries, and poor people have small libraries and big TVs.” There are activities that are considered recreational but, in fact, they just waste your time like computer games, entertaining videos, scrolling through social networks, and hanging out in bars. These activities may be a sign that you’re not interested in your life.

Business coach, Jaime Tardy, believes that “the primary difference with wealthy people is that they’re in control of their money, and they don’t let money control them.” If you don’t care how much money will stay in your wallet after you go shopping, you and wealth might not be good together. To become rich, you should know your income and expenses at every moment. This will help you plan your budget, prepare for unpleasant surprises, and, paradoxically, it’ll help you take it easy.

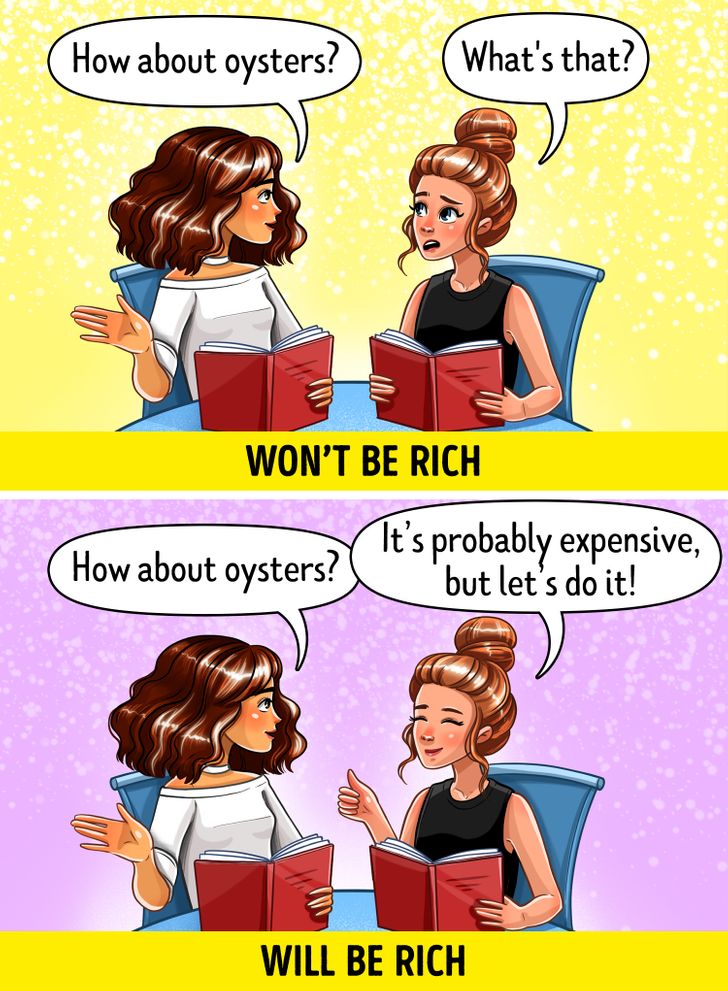

A person won’t become rich, if they don’t know their limits. The tunnel vision that protects our brains from useless or harmful information is able to exclude foods that are “too expensive,” entertainment, and luxury goods from our reality, so we won’t have the motivation to earn more. For example, the author of this article knows people who don’t notice either the assortment nor the prices while walking past shelves with seafood. But the high price is just a reason to ask yourself, “What do I have to do to be able to afford that?”

“If you can’t buy it twice, you can’t afford it” is a saying popularly attributed to musician and billionaire, Jay-Z, in an interview. This rule applies to all purchases except real estate. If the smartphone you are thinking about buying, which is equal to your monthly salary, suddenly gets broken, you’ll hardly be able to buy the same one the next day.

A vacation you paid for with a credit card is a clear sign that something is wrong with your finances. There’s no doubt that a person needs to take a break and relax from time to time, but going into debt for it is a bad idea, because you’ll have to pay off your debt for this vacation instead of saving money for the next one. One of the Founding Fathers of the United States, Thomas Jefferson, advised that one should not spend their money before they have it. Although in his time, there were no credit cards, but there were still more than enough opportunities to go into debt.

The world is changing at an incredible rate, and you have to run just to stay in place. If you regularly don’t spend time and money on acquiring and improving your professional skills, in the best case scenario, you’ll be able to maintain your current income level, but you’ll have to forget about wealth. When Elon Musk was asked how he learned to build rockets, he said, “I read books.”

Cleaning and cooking are activities that are hard to avoid, but it’s wrong to spend too much time on them. There are only 24 hours in a day, and after sleep and going to work, you have only 5-6 free hours at best. If you spend them on dusting, making soup, and roasting chicken, there’ll be no time left to improve your life. And when our time is worth more than the services of professionals, it’s more profitable to delegate household chores to them.

Sharing the ways you’re planning to become richer only makes sense to people who will support you, but there are very few of these people. And most people will “mean well” by trying to bring you back down to earth and explaining to you why you’ll fail. There is even a concept called crab mentality that describes this behavior.

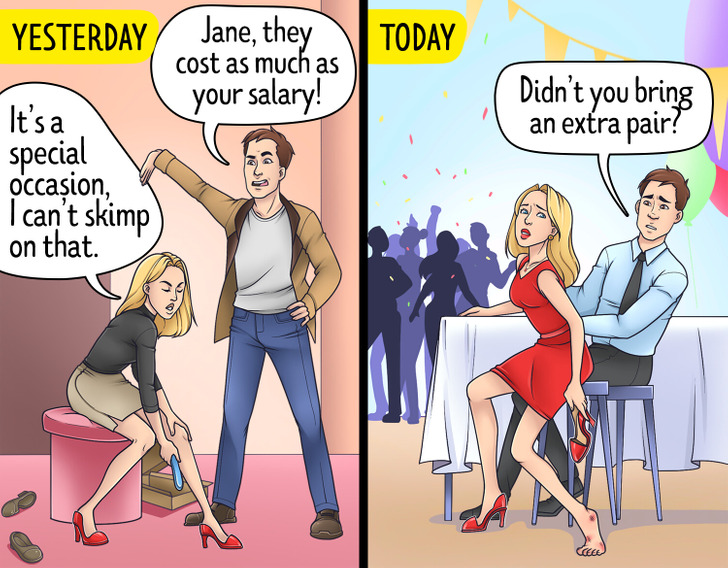

Events that inevitably lead to spending take place in our lives every now and then. But situations can be different, and you should be able to distinguish when expenses are really necessary and when you can pacify your extravagance.

It’s pretty easy to take notice of these events: you need to think in advance about all the situations and make a list of when spending is ok and when it’s not. It’s worth putting only the things that require attention on this list: diseases, losing a job, the breakdown of home appliances that are hard to live without, or an urgent need to buy shoes for the upcoming season. In all other cases, you need to say no to all unexpected spending because the purchase of a very expensive pair of shoes or a dress that will only be worn once is a senseless waste of money, even if they were bought to attend your best friend’s wedding.

Here are a few more pieces of evidence that the behavior of the rich and the poor differs significantly. We hope this will assist you on your journey to a prosperous life.